Blog review

Labels: feedback

Trading sense by a busy non-professional trader

Labels: feedback

Labels: daily recap

Labels: Trades

Labels: Trades

Labels: Trades

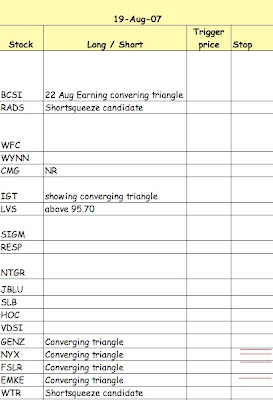

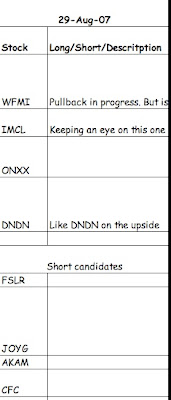

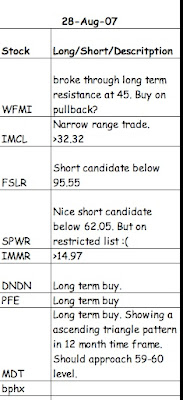

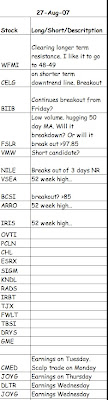

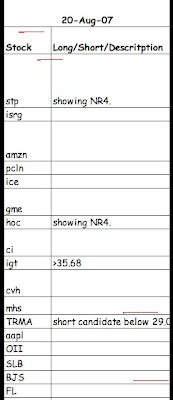

Labels: Watchlist

Labels: Watchlist

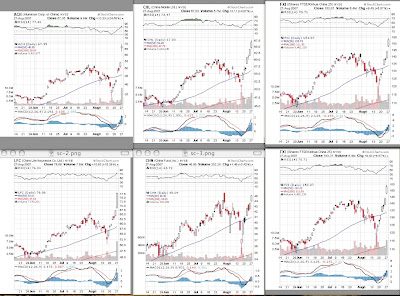

Labels: Outlook, Trades, TRADING IDEAS

Labels: Trades

Labels: Trades

A word of caution on the markets. I still think there may be a bit of upside before we retest last weeks lows. Corrections of this magnitude usually taking a couple of months to bottom out and with the credit crisis looming over the financial markets, it is a tough tell.

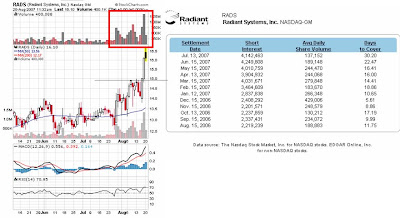

Labels: RADS, short squeeze